How to Unlock Cash Conversion to Skyrocket Your Small Business Financial Planning Success with 1 Template

Profit doesn't matter…

If you don’t have control over your cash. You can’t spend profit, but you can spend cash.

Effective small business financial planning is the key to ensuring that you have the cash you need when you need it.

And suppose you're like many small business leaders. In that case, you're often focused on what drives revenue and profit but neglect the most crucial location—what's in your bank account. For years, that's all I demanded—revenue, gross profit, oh my. I drove significant revenue increases, but it made other areas fragile. Money would come in and go out faster than I could say "profit."

This isn't just about flipping the script; it's about understanding the bloodline of your business—cash flow.

Profit looks good on screen, but cash fuels growth, creates liquidity, and prepares you for tough times.

There's one metric that stands head and shoulders above the rest when it comes to improving your financials.

It's the unsung hero of the business world: the Cash Conversion Cycle (CCC).

Jeff Sands acknowledges, "The cash conversion cycle is the single most reliable, simple, immediate, and valuable lever in all of business. If I had to live an entire business career with only one tool it would be this one, hands down."

What Is the Cash Conversion Cycle? Why Does It Matter?

The Cash Conversion Cycle is your business's lifeline to liquidity and a crucial aspect of small business financial planning.

It's that vital span where your working capital is tied up, funding the gears that keep your enterprise running. Think of it as your cash-exposure window. Ignore it, and you're essentially operating the machine blindfolded.

The CCC tells you how long it takes for a dollar to go from inventory to cash in the bank, which is essential for effective small business financial planning

Cash is useless when it's tied into inventory and accounts receivable.

It's pivotal for any business, not just those dealing with physical inventory. If you're in the service industry, it's called the Service-to-Cash Cycle.

How to Evaluate the CCC Metrics.

Any number below zero is worth celebrating.

It means you're so efficient customers are practically throwing money at you before you have to pay your suppliers. Your inventory is just enough to satisfy orders, and you're not letting accounts payable gather dust.

Then there's the positive number.

It indicates you may carry more inventory or accounts receivable than necessary, highlighting the importance of small business financial planning.

Basically, you're slower to collect cash than you are to pay out.

It's this insight that will help you make better decisions, like:

"How can we improve our collections procedure?"

"Can we get more favorable terms from vendors?"

"Are we stocking only what's necessary? Do we need to re-work our stock and purchase order processes?"

But every business is different.But every business is different, and that's where small business financial planning comes into play.

What's a poor metric in one industry could be a great metric in another. For example, a B2B aerospace firm with a 30-day CCC is optimal. However, if an e-commerce store had the same CCC metric, it would be a problem.

Here are some general CCC reference metrics for various industries, highlighting the need for small business financial planning:

Retail Industry: A well-run retail operation might aim for a CCC of under 30 days, especially if they deal in perishable goods or fast-moving consumer items.

Manufacturing Industry: In manufacturing, a CCC between 40 to 70 days might be more typical due to the complexity and time needed for production.

Tech Companies: Companies that offer digital goods or subscription-based services might even aim for a negative CCC, meaning they collect payments before any costs are incurred, a strategy often achieved through effective small business financial planning.

Construction Industry: This sector can often have a longer CCC due to the long-term nature of projects. Here, 60 to 90 days might be expected.

Automotive Industry: Given vehicles' high costs and long production times, a CCC of around 40 to 60 days could be considered efficient.

How Do You Calculate the Cash Conversion Cycle?

You have two options: Manual or Spreadsheet.

Surprise! Both will work, but a simple spreadsheet will save you time.

Here's the formula you'll be calculating for successful small business financial planning:

CCC = Inventory Conversion Period + Receivable Collection Period - Payables Deferral Period

Inventory Conversion Period = (Avg. Inventory / Daily COGS) * Days in Period

Receivable Collection Period = (Receivables / Daily Sales) * Days in Period

Payables Deferral Period = (Payables / Daily COGS) * Days in Period

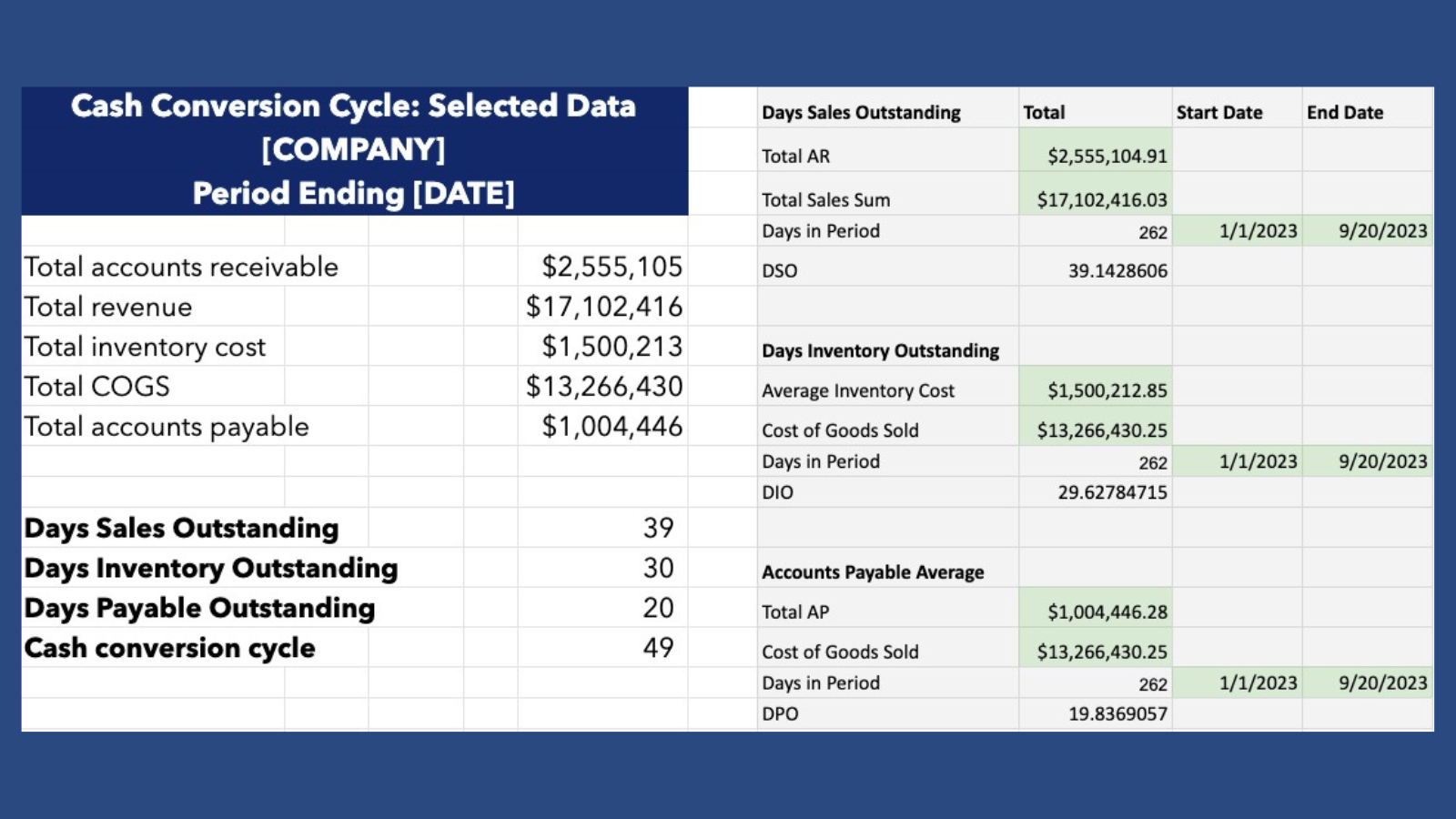

The Spreadsheet:

Grab this Google Sheet template.

Make a copy or download it.

Enter your start and end dates in the green cells.

Pop in your financial numbers in the remaining green cells.

And voila, there's your CCC, a valuable tool for effective small business financial planning.

The sheet will automatically calculate the Days Sales Outstanding, Days Inventory Outstanding, Days Payable Outstanding, and your Cash Conversion Cycle.

Don't just gloss over this and return to your 'busy' day.

This powerful metric is the Swiss Army knife that can slice through your financial fog. It's the tool that can supercharge your cash flow and position your business for long-term success, thanks to effective small business financial planning.

Heck, it's like squats for your financial health—a fundamental you cannot afford to ignore unless you prefer a brittle foundation.

Download a Cash Conversion Cycle spreadsheet, fill it in, schedule a think time session, and uncover the golden insights hiding in your financials, all as part of your comprehensive strategy for small business financial planning.

This simple tool will help you make powerful decisions in your business.

Make the switch to focus on cash, and you'll never look back, thanks to the benefits of small business financial planning.